RBI MPC Meet: No change in repo and reverse repo rates for the ninth time in a row.

New Delhi:

In the meeting of RBI Monetary Policy in the month of December policy rates (RBI Benchmark Rate) has not been changed once again. Amid Omicron’s concern, the Monetary Policy Review Committee of RBI has decided not to make any change in the benchmark rate. The repo rate has once again been retained at 4%. Repo rate has been kept at -4 percent and reverse repo rate at 3.35 percent. Repo rate is the rate at which RBI lends short term to banks and reverse repo rate is the rate at which it borrows from banks.

read also

Due to the creation of uncertainty in the country due to the new variant of Coronavirus, Omicron, market analysts believed that this time also the RBI will not make any changes in the policy rates. This is the ninth time in a row that the Monetary Committee has not made any change in policy rates.

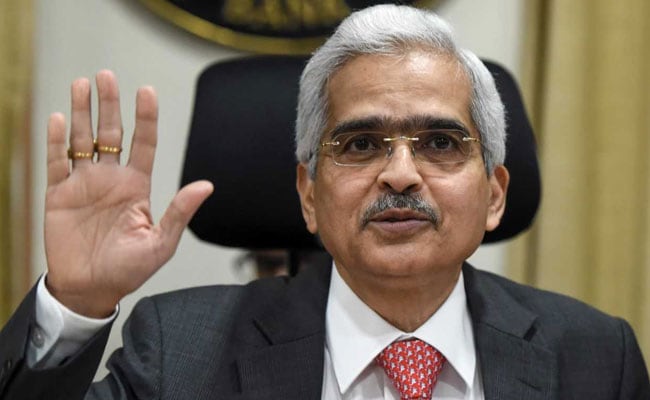

RBI Governor Shaktikanta Das said in the press conference that the committee has decided to maintain its ‘Accommodative Stance’ to support the economy amid Kovid-19. He said that the Indian economy has come out of the biggest decline, we are better prepared to deal with the Kovid-19 epidemic. Das said that the economic recovery is accelerating, but not strong enough to continue the steady uptrend on its own. The governor also said that the outlook is looking negative due to Omicron’s infection.

On the economic recovery, he said that consumer demand is showing improvement, while urban demand is also getting stronger. Lower tax rates on petrol, diesel prices should help consumption demand.

RBI Governor Das said that the central bank will continue to manage cash to maintain financial stability and RBI will allow banks to infuse capital and remit profits to foreign branches without its prior approval.

This time too RBI has kept the real GDP growth forecast at 9.5% for the financial year 2021-22. The forecast for retail inflation has been further kept at 5.3% for FY22. The CPI inflation estimate is also stable at 5.3%. The MPC has been entrusted with the responsibility of maintaining inflation at 4 per cent with 2 per cent variation.